Top Guidelines Of Opening An Offshore Bank Account

Table of ContentsOpening An Offshore Bank Account - QuestionsFascination About Opening An Offshore Bank AccountThe Only Guide for Opening An Offshore Bank AccountThe Definitive Guide for Opening An Offshore Bank Account

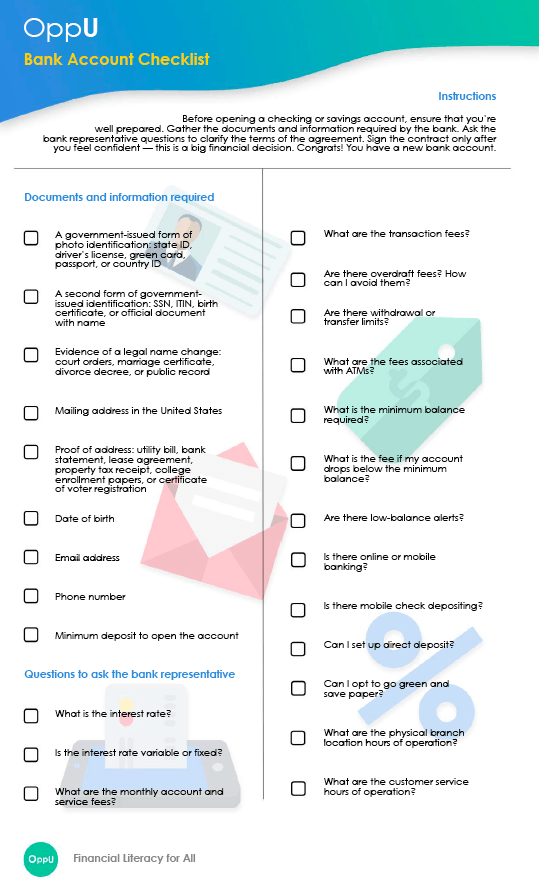

If the kid is not able to supply address confirmation papers in their very own name, we can approve those of a parent/guardian given the surname and address are specifically the same. If you have a various surname, we will certainly require to see a legal document such as a long birth certification.

Trainees that desire to open a UK financial institution account might need a letter of introduction from the College to offer to the financial institution when they use to open up an account. Typically only international students will certainly require this letter, if you are a UK pupil a certification of registration which you can generate from the S3P student site will typically be enough to confirm your standing as a trainee.

If you are struggling to book an in-person appointment with a bank, you might have the ability to discover an online consultation at an earlier day. You might join an on the internet bank. Some instances of financial institutions consist of: Santander HSBC Lloyds TSB Barclays Nationwide Revolut (on-line financial institution) Starling (online financial institution) Monzo (online bank) (opening an offshore bank account).

Not known Details About Opening An Offshore Bank Account

Having a financial institution account is thought about one of the standard indications of financial security. It shows that a person has their funds controlled and permits them access to other financial items. In many ways, a savings account holds the essential to the whole world of financing. Nonetheless, it is a globe that is obstructed off for lots of who discover it hard to hop on the very first action of the economic ladder by opening a checking account.

Right here are some actions you can take if you have actually had difficulty opening up a bank account with a financial institution or building society: Check Your Credit Scores Record If you have actually been denied for a savings account as a result of a inadequate credit rating, you need to check specifically what your debt record claims.

It will certainly supply you with information of any kind of loaning you have actually made in the past in addition to details of any type of missed out on settlements. Financial institutions and financial organizations likewise utilize your credit rating record to verify your identity. Make the effort to experience your record to figure out if there is any kind of imprecise details had in it.

You can test any kind of element of your credit rating while you must likewise see to it that all the information regarding your identity are precise and up to day. Standard Financial institution Accounts You can also discover the alternative of opening up a fundamental savings account. These are accounts that do not supply charge card or overdraft facilities.

The 10-Second Trick For Opening An Offshore Bank Account

Some fundamental savings account come with a monthly cost and a minimal regular monthly down payment requirement. Prepaid Cards If you can't open up a savings account, you can still get a debit card by discovering the numerous alternatives for prepaid cards. A pre paid debit card operates in similarly as a typical debit card in that it has a card number as well as expiration day in addition to a CVC number on the back.

You should pack funds onto the card to use it as well as you can just invest the cash that is on the card at any type of time - opening an offshore bank account. This suggests there is no credit entailed as well as therefore it is a good option for a person who can not open a bank account due to credit rating problems.

Matches Me gives account owners Resources with a present account that is stuffed filled with financial attributes consisting of the option to make settlement transfers, manage straight debits, established up standing orders as well as extra. All banking functions can be managed via electronic banking as well as our mobile banking application that is available to download and install from both the Apple Store and also Google Play Shop. Coronavirus (COVID-19) banking upgrade Applications Full Article for settlement holidays have currently closed however banks are still supplying tailored assistance to clients that are affected by the coronavirus outbreak. Continue top of the latest information and guidance pertaining to the COVID-19 pandemic with Which? Before you start: exactly how to compare checking account Opening a bank account is an essential financial landmark.

Picking the appropriate existing account will certainly depend on the way you spend as well as manage your cash. Below are some things to think about when comparing accounts: Does the bank have a good online reputation?

The Best Strategy To Use For Opening An Offshore Bank Account

If you're opening an account from scratch, it will certainly rely on the way you open the account. Santander says successful on-line applicants will be sent their account information and debit card within 7-10 functioning days yet if it can validate your identity over the phone, you'll be able to open the account right away.